As inflation drives up household bills, a new poll by the Angus Reid Institute (ARI) that surveyed Canadian adults found that just over half (53 percent) of the respondents agreed or strongly agreed with the statement that they “can’t keep up with the cost of living,” as inflation drives up the price of essential goods.

“Canadians’ household budgets are becoming squeezed from all angles as the price of goods rises. The costs of food, gasoline, and energy in particular are adding to household bills,” the ARI said in a Feb. 28 news release.

The findings come as Canada’s inflation rate, measured by the Consumer Price Index, surpassed 5 percent in January 2022, reaching the highest level since 1991, according to data from Statistics Canada.

The survey also found that half of the respondents (51 percent) said they would be unable to cover an unexpected $1,000 expense. Of those respondents, one-in-seven said they couldn’t deal with a surprise bill of any amount because their budget is already overstretched.

In response to the inflation, three-quarters of Canadians say they’ve modified their spending in recent months. Discretionary spending (53 percent), major purchases (41 percent), extra car trips (31 percent), and vacations (29 percent) are some of the things that Canadians say they have avoided recently. Another 22 percent said they have de-prioritized savings.

Stressed About Money

The ARI survey said that the “current financial waters are swamping” an overwhelming proportion of Canadians. Seven in ten say they are “stressed about money,” while only one-quarter of the respondents say they are never stressed about financial issues recently.

“At least three-in-five across all age-gender groups say they carry this stress,” the ARI said.

The potential loss of jobs is also a major financial concern across the country.

Different Regions

There are regional discrepancies which show that some parts of the country are struggling more than others. Two-thirds (65%) of those in Saskatchewan fall into the more challenged half of the Index, as well as approaching three-in-five (57%) of those in Atlantic Canada.

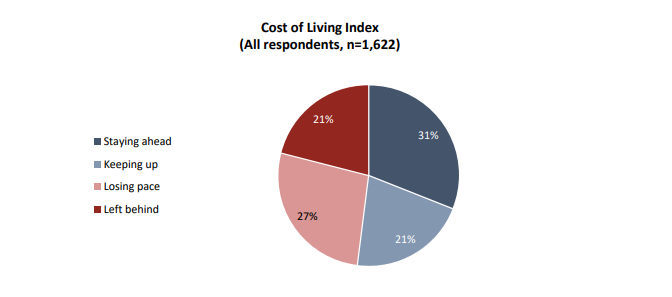

There are demographic differences, too. A larger proportion of women than men are being squeezed by cost of living increases and fall into the Losing Pace or Left Behind groups as noted in the chart above. As well, those aged 35 to 54 are much more likely than other age groups to be Left Behind.

Three-quarters of those in households earning less than $25,000 annually are either Losing Pace or Left Behind. Meanwhile, more than two-in-five (45%) of those in households earning $150,000 or more annually are Staying Ahead.

To see the complete study visit the website HERE.